Back in April I wrote that I hoped that market beating results would start to get repetitive and we have another consecutive market beating quarter.

The SPY was down -8.571% in Q2 for an annual decline of -12.71% so far this year.

The quarter isn’t complete yet, but what are the unaudited portfolio results so far?

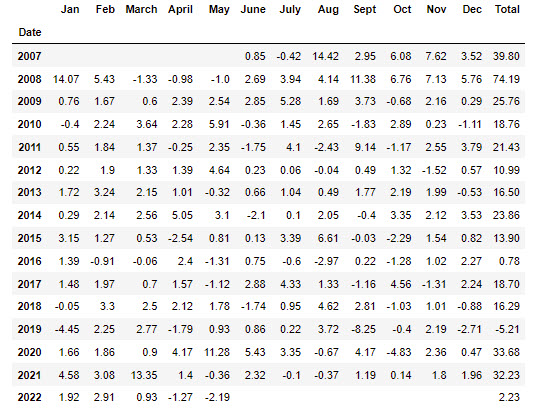

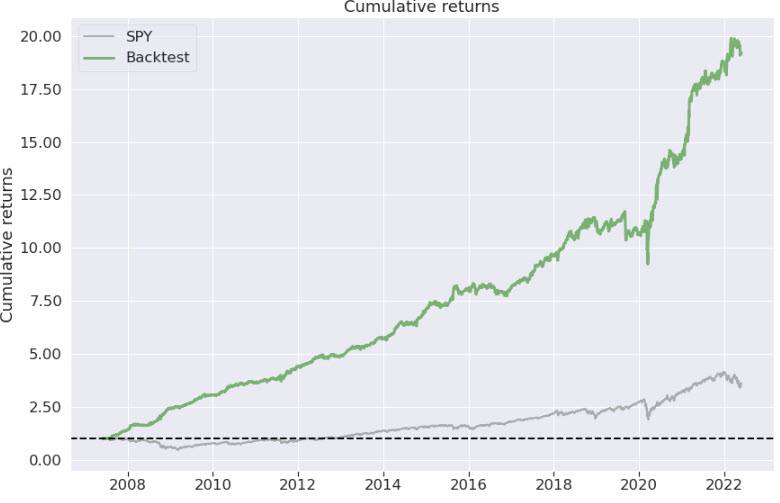

High Sharpe Portfolio

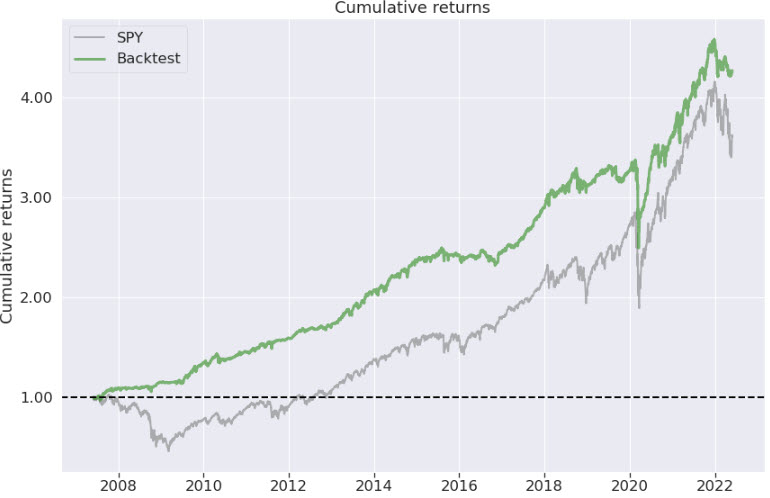

The theoretical returns for the High Sharpe portfolio were 2.23% for the first half.

This is truly remarkable when you consider several factors.

1. This represents an outperformance of the benchmark of by 1502 basis points. Yes, you read that right.

2. According to a 2020 report, over a 15-year period nearly 90% of managed investment funds failed to even match the market.

Note: These returns don’t include any slippage, interest expense, missed trades due to hard to borrow stocks, or other day to day reasons why the real world intrudes on theoretical maximum returns.

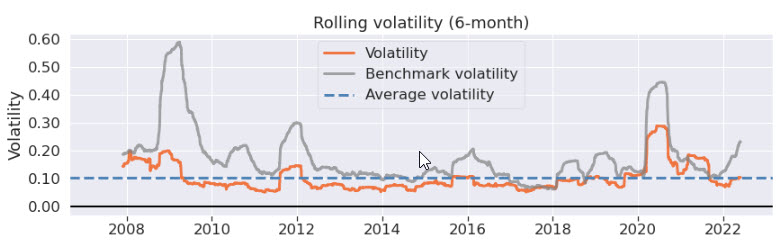

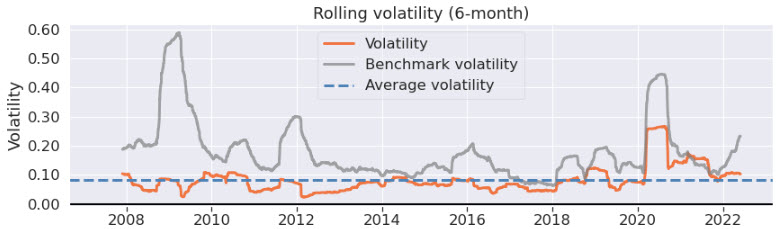

It’s also worth pointing out that these results are achieved at lower volatility than the SP 500 – and the few times that volatility in the portfolio does exceed the benchmark are usually associated with outsize gains.

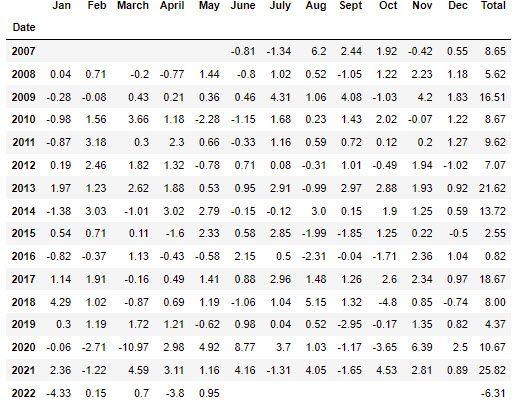

Quantum Return Portfolio

The theoretical returns for the Quantum Return portfolio were -6.31% first half of 2022.

These returns don’t include any slippage, interest expense, missed trades due to hard to borrow stocks, or other day to day reasons why the real world intrudes on theoretical maximum returns.

The Quantum Return Portfolio is beating the the SP 500 by 6480 basis points which is fantastic performance given that the fund is unleveraged and is unable to take advantage of some strategies (selling short).

This however makes it ideally suited to serve. protect, and grow IRA assets which are prohibited from investing in this manner.

Notice also the lower volatility exposure of the portfolio relative to the SP500 – again we see the benefit of multiple, uncorrelated strategies with edge in a portfolio approach!

Real World Results and Market Update

Portfolio results were nominal again – well in line with expected results. The High Sharpe portfolio in particular reported results almost exactly in line with theoretical results.

I’d also like to say something on the significant market drop on 5/13/2022. This was a big move for the market and it has resulted in an almost complete buy in for the mean reversion strategies.

Market moves like this don’t happen very often. That being said markets almost never move straight down and the odds of a relief rally are very high.

What the High Sharpe and Quantum Return portfolios will do in the case of that high probability outcome is use that relief rally to sell out the inventory acquired at high fear prices and (hopefully) bank some profit for our investors.