The market is experiencing uncommon volatility as we navigate the aftermath of the recently announced Fed increase of 50 basis points.

Making a handful of good uncorrelated bets that are balanced and leveraged is the core principle behind all our portfolios.

But do we really trust these principles when the pressure of the markets truly asserts itself? It can take real courage to be in a portfolio that potentially uses 3x leverage intraday.

In order to have that courage, we need more than just “guts” – we need a solid foundation of research and a good reason to stay the course.

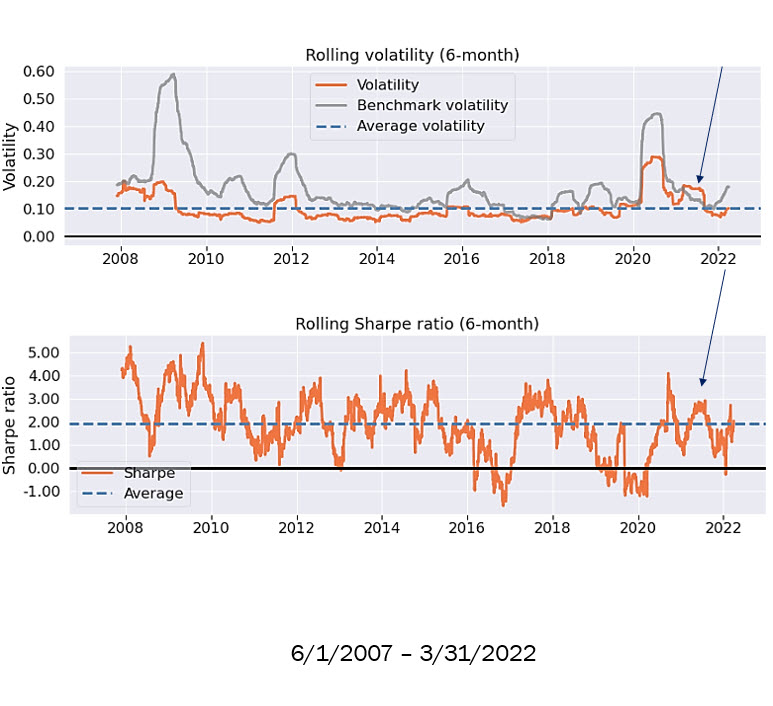

Let’s take a look at the backtested historical volatility of the High Sharpe Portfolio from 6/1/2007 – 3/31/2022.

The rolling volatility tells the story. For almost the entire period actual volatility is below the benchmark (SP500) volatility. This is not despite using 3x leverage – this is only possible BECAUSE we are using 3x leverage AND multiple uncorrelated strategies with edge in the portfolio!

Of particular interest is the period highlighted by the two arrows at the end of 2021. You will note that during this period volatility of the portfolio did exceed that of the benchmark – however if we also check the corresponding value of the Sharpe values for that time, they are well above zero which indicates an overperformance relative to the market.

That’s the kind of volatility we can all appreciate!