We definitely had the buying opportunity I talked about on 5/19/22 – and the funds are completely out of all their mean reversion trades at a nice profit, but now the markets have gone completely the other way and are considerably overextended to the long side.

The High Sharpe Fund has taken advantage of this probable overreaction by entering into a number of short positions that should pay off in the coming days if the market eases off a bit.

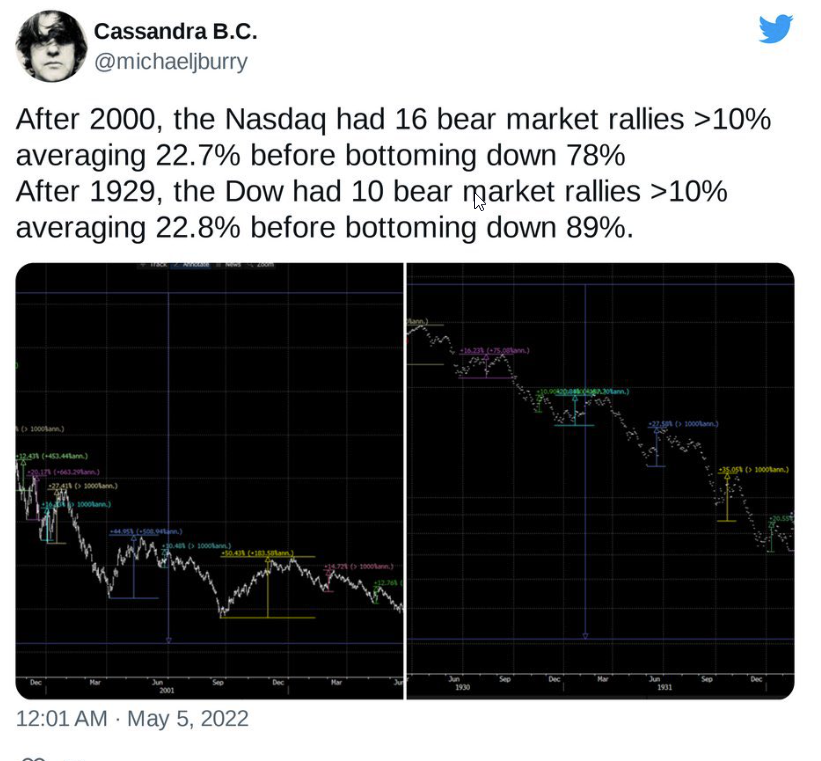

Is this normal behavior? Is this the end of the Bear Market? I have real doubts that we have seen the bottom. The above graphic is a post from Michael Burry on 5/5/22 pointing out that Bear markets often see rallies like this after extreme sell-offs. You may recall the name Michael Burry – he is famous for being right on “The Big Short” he made billions in the housing crisis of 2008.

Have a nice Memorial Day weekend and let us be thankful for those who sacrificed for our freedom!